Property Tax Breaks Coming to 7 States After Recent Voter Decisions

According to Moneytalksnews , Several states across the U.S. are set to introduce or expand property tax breaks in 2025, providing homeowners with new financial relief. These changes come as property taxes were a key issue in the recent elections, with 36% of voters rating them as “extremely important.” As a result, voters in multiple states approved new legislation that will reduce the tax burden for homeowners, particularly in times of economic strain.

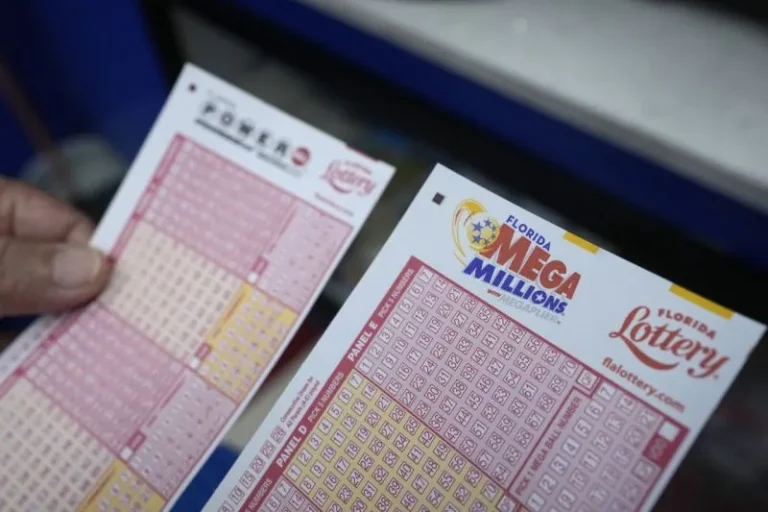

Florida: Amendment No. 5

Effective: January 1, 2025

Florida voters passed Amendment No. 5 with overwhelming support (66%), which will adjust the state’s existing homestead exemption for inflation. This annual adjustment will help homeowners with primary residences benefit from increased property tax breaks as inflation rises, ensuring they aren’t burdened by higher property taxes due to increased home values.

Arizona: Proposition 312

Effective: 2025 tax year

Approved by 58% of voters, Proposition 312 offers property tax refunds for residents if their local government fails to enforce specific public nuisance laws, such as those against loitering and panhandling. Property owners in both cities and unincorporated areas can apply for a refund once a year if their local government neglects these duties.

Colorado: Amendment G

Effective: 2025 tax year

Nearly 73% of Colorado voters approved Amendment G, which extends eligibility for property tax exemptions to disabled veterans who are unemployable due to their disability, even if they are not permanently and totally disabled. This expands the benefits of Colorado’s existing homestead exemption for veterans.

Georgia: Amendment 1

Effective: January 1, 2025

Georgia voters (63%) approved Amendment 1, which limits the annual increase in property assessments to prevent them from surpassing inflation. This will help control property tax hikes by holding down the assessed value of homes.

New Mexico: Amendment 1

Effective: Immediately

New Mexico voters passed Amendment 1 with 83% approval, extending the state’s property tax exemption to all service-disabled veterans and their widows or widowers. Previously, only veterans who were 100% disabled were eligible. Now, those with partial disabilities can qualify for a tax exemption based on their federal disability rating.

New Mexico: Amendment 2

Effective: Immediately

Also passed by 72% of New Mexico voters, Amendment 2 increases the value of the property tax exemption for honorably discharged veterans and their families from $4,000 to $10,000. This amount will also be adjusted annually for inflation.

Also Read – November Social Security Payments for 62-Year-Olds: Get Your $2,710 in Six Days

Virginia: Amendment to Article X

Effective: January 1, 2025

A remarkable 93% of Virginia voters supported an amendment that expands eligibility for a property tax exemption for surviving spouses of soldiers killed in combat. The new law extends the exemption to surviving spouses of any soldier who died in the line of duty, not just those killed in action.

Wyoming: Amendment A

Effective: January 1, 2026

Wyoming voters approved Amendment A, which creates a new classification for homes as “residential real property.” This change, passed by a majority of voters, will not immediately reduce property taxes but sets the stage for residential real estate to be taxed differently from other types of property, such as industrial real estate.

These legislative changes, passed in the 2024 elections, will provide substantial relief to homeowners across the country, especially for veterans, disabled individuals, and low-income families.