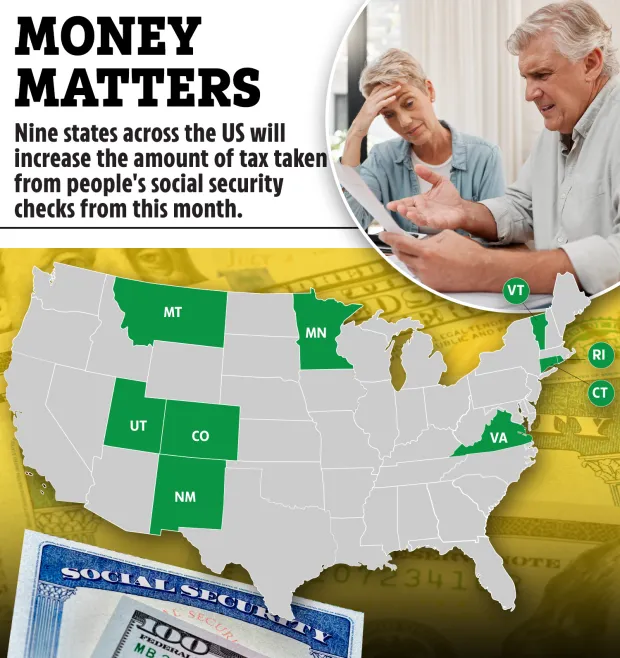

People in 9 states to get skimpier Social Security checks from today – map shows where you could get up to $200 less

SOME Americans may see reduced amounts in their Social Security checks this month due to a tax hike affecting nine U.S. states. These states are set to increase the tax deducted from residents’ Social Security benefits, which may lead to smaller payments starting from September.

Affected States

The nine states impacted by this tax increase are:

- Colorado

- Connecticut

- Minnesota

- Montana

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia

In contrast, the remaining 41 states do not impose income tax on Social Security benefits, according to Investopedia.

Understanding the Impact of the Tax Hike

Social Security benefits are determined by an individual or couple’s total income, meaning the effect of this tax increase will vary based on the state in which a person resides. Generally, those receiving larger Social Security checks will likely face higher taxes. However, it’s worth noting that some states, including Colorado, are expanding their Social Security tax exemptions for qualifying seniors, as reported by AARP.

The Scope of Social Security Benefits

Approximately 68 million Americans receive Social Security payments each month, costing the government a staggering $1.5 trillion annually. About 40% of recipients are subject to federal or state taxes on their benefits, often due to having significant additional sources of income.

Tax Deductions and Payment Details

The new tax deductions will typically be applied when individuals file their federal tax returns. The average Social Security retirement check is $1,918 per month, with the potential for payments to reach as high as $4,873.

Nearly nine out of ten individuals aged 65 and older receive Social Security benefits, which generally account for about 30% of their total income. According to the Social Security Administration (SSA), individuals who retire at the official retirement age this year can expect a maximum monthly benefit of $3,822.

Maximizing Social Security Payments

Interestingly, delaying retirement can lead to higher benefits. The SSA notes that if you retire at age 70 in 2024, your maximum benefit would be $4,873, whereas retiring at age 62 in the same year would yield a maximum of $2,710.

Staggered Payment Schedule

Due to the large number of recipients, Social Security payments are typically staggered throughout the month.

Scam Alert: Fraudulent Email Claims

In related news, a woman recently received a scam email stating that her Social Security number was at risk of being revoked. The email falsely claimed that Joyce House’s number was linked to drug trafficking and other criminal activities. Fortunately, she recognized the email as a scam and is now sharing her story to warn others about potential fraudulent schemes.

“I hope that if [the scammers] reached out to anyone else, they’ll not fall for this,” House stated.